The method used is the choice of the finance director. For example depreciation is recorded as a monthly expense. Cash inflows proceeds from capital financing activities include. Cash flows shown in bracket are treated as minus figures while making total. In recent years the FASB issued ASU 2016-152 and ASU 2016-183 which clarified guidance in ASC 230 on the classification of certain cash flows and removed some of. Cash Flow Statement Direct Method. Many companies present both the interest received and interest paid as operating cash flows. As we know current year profit is the final figure in the income statement. Statement of Cash Flows. Retained earnings is simply accumulated profits.

Bank overdraft is to be treated as a reduction from cash and cash equivalents. For example depreciation is recorded as a monthly expense. Offsetting cash inflows and outflows in the statement of cash flows 51. However SEBI which amended clause 32 of the Listing agreement in 1995 requiring all listed companies to prepare a Cash Flow Statement has provided format for Cash Flow Statement. Income taxes and sales taxes 8. Many companies present both the interest received and interest paid as operating cash flows. It is the total of profits that have been accumulated over the years for the. The income statement considers bad debt as an expense. Assets Liabilities Stockholders Equity Cash Noncash Assets Liabilities SE Cash L SE NCA Cash L SE NCA This means that we can evaluate changes in cash by. We come up with the following rule.

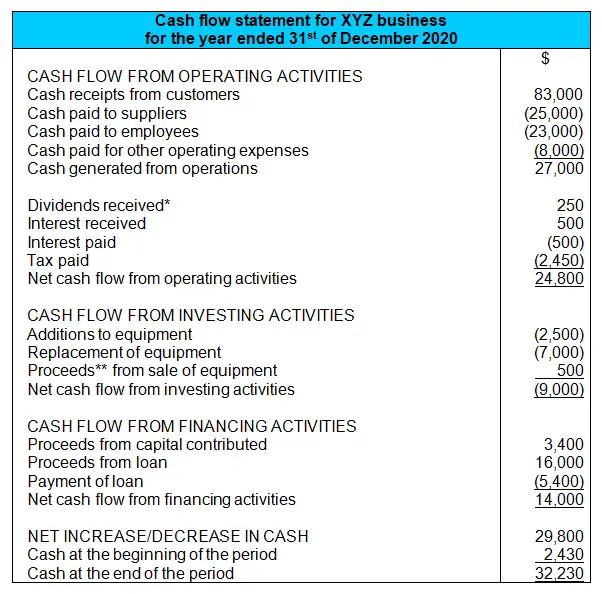

We come up with the following rule. In recent years the FASB issued ASU 2016-152 and ASU 2016-183 which clarified guidance in ASC 230 on the classification of certain cash flows and removed some of. The cash flow statement makes adjustments to the information recorded on your income statement so you see your net cash flowthe precise amount of cash you have on hand for that time period. Effect of bank overdrafts on the carrying amount of cash and cash equivalents 52. Noteworthy line items in the cash flow from financing section include proceeds from borrowing under a revolving credit facility proceeds from the issuance of notes proceeds from an equity. The following is widely used format of Cash Flow Statement. Net income from the income statement shows up at the top of the operating section on the cash flow statement. Offsetting cash inflows and outflows in the statement of cash flows 51. The income statement considers bad debt as an expense. The method used is the choice of the finance director.

Income taxes and sales taxes 8. Others treat interest received as investing cash flow and interest paid as a financing cash flow. In recent years the FASB issued ASU 2016-152 and ASU 2016-183 which clarified guidance in ASC 230 on the classification of certain cash flows and removed some of. We may sell the inventory on credit so cash not yet receive too. Many companies present both the interest received and interest paid as operating cash flows. Effect of bank overdrafts on the carrying amount of cash and cash equivalents 52. Presentation of operating cash flows using the direct or indirect method 7. Therefore amounts generally described as restricted cash and restricted cash equivalents should be included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period total amounts shown in the statement of cash flows. Noteworthy line items in the cash flow from financing section include proceeds from borrowing under a revolving credit facility proceeds from the issuance of notes proceeds from an equity. Statement of Cash Flows.

It is the total of profits that have been accumulated over the years for the. The income statement considers bad debt as an expense. The following is widely used format of Cash Flow Statement. For example depreciation is recorded as a monthly expense. Say your income for the quarter is 125000. Others treat interest received as investing cash flow and interest paid as a financing cash flow. On the other hand the decrease of inventory will make cash inflow as we have sold them. Inventory increase Cash Outflow negative Inventory decrease Cash Inflow positive What if we purchase inventory on credit so there is no cash flow. So the amount of bank overdraft will be deducted from cash and cash equivalents to ascertain the net cash and cash equivalentsTherefore Closing Cash and Cash Equivalents Opening Cash and Cash Equivalents - Bank Overdraft cash credit are bank overdraft are similar I. Effect of bank overdrafts on the carrying amount of cash and cash equivalents 52.