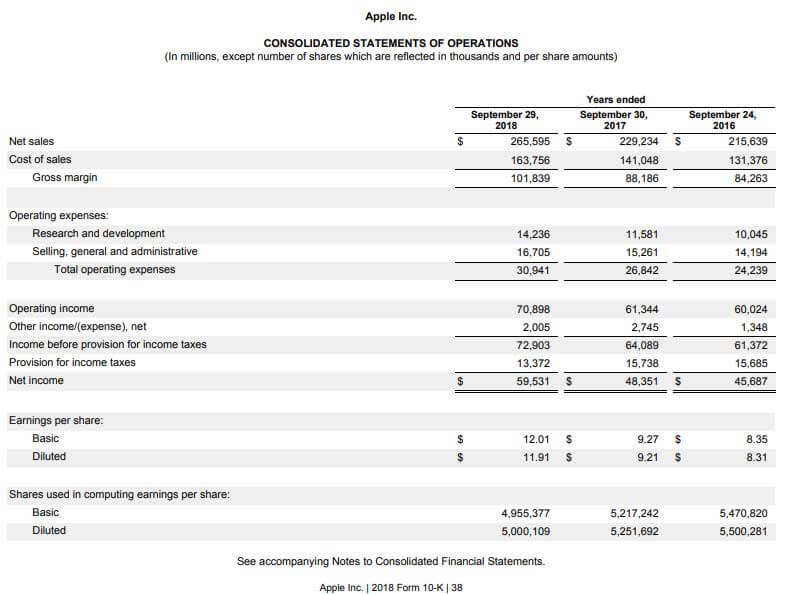

There are four main types of financial statements which are as follows. The income statement is sometimes called the statement of financial performance because this statement lets the users assess and measure the financial performance of an entity from period to period of the similar entity competitors or the entity itself. The profit or 2 the Balance Sheet Balance Sheet The balance sheet is one of the three fundamental financial statements. The four main types of financial statements are. Managers or Management. A profit and loss statement goes by a number of other names including income statement earnings statement earnings report and operating statement. Financial performance analysis can focus. A statement that captures how cash flow is affected by activities from the balance sheet and income statement categorized into operating investing and financing activities. Here are the five statements. The balance sheet the income statement and the cash flow statement are three of the most significant financial statements used in performance analysis.

In other words it lists the resources obligations and ownership details of a company on a specific day. A document that describes the companys operations and financial conditions and typically includes the documents listed above in addition to other insights and narrative from key. Noted to Financial Statements. The financial statements are key to both financial modeling and accounting and 3 the Cash Flow Statement Statement of Cash Flows The Statement of Cash Flows also referred to as the cash flow statement is one of the three key financial statements that report the cash. Income statement balance sheet and cash flow statement. Financial analysis means the analysis of the financial statement to reach up to the productive conclusion which will help the investors and other stakeholders to maintain their relationship with the company and there are various types that experts and analysts use to do a post-mortem of financial statements. A statement that captures how cash flow is affected by activities from the balance sheet and income statement categorized into operating investing and financing activities. The balance sheet the income statement and the cash flow statement are three of the most significant financial statements used in performance analysis. SEBI and Stock Exchanges. The statement of financial position often called the balance sheet is a financial statement that reports the assets liabilities and equity of a company on a given date.

The statement of financial position often called the balance sheet is a financial statement that reports the assets liabilities and equity of a company on a given date. Three financial statements comprise the statement of financial performance. Statement of Comprehensive Income. Noted to Financial Statements. In other words it lists the resources obligations and ownership details of a company on a specific day. It begins with sales and then subtracts out all expenses incurred during the period to arrive at a net profit or loss. This can take the form of one statement or it can be separated into a statement of income recognising income and expense realised based on the accrual accounting concept and a statement of other income recognising revenues expenses gains and losses that are excluded from the statement of income because they were not yet realised. Managers or Management. A statement that captures how cash flow is affected by activities from the balance sheet and income statement categorized into operating investing and financing activities. Here are the five statements.

Managers or Management. The income statement is sometimes called the statement of financial performance because this statement lets the users assess and measure the financial performance of an entity from period to period of the similar entity competitors or the entity itself. A statement that captures how cash flow is affected by activities from the balance sheet and income statement categorized into operating investing and financing activities. A record or statement of financial expenditure and receipts relating to a particular period or purpose. The financial statements must present fairly the financial position financial performance and cash flows of an entity. The financial statements are key to both financial modeling and accounting and 3 the Cash Flow Statement Statement of Cash Flows The Statement of Cash Flows also referred to as the cash flow statement is one of the three key financial statements that report the cash. Statement of Financial Position Statement of Financial Position also known as the Balance Sheet presents the financial position of an entity at a given date. The balance sheet the income statement and the cash flow statement are three of the most significant financial statements used in performance analysis. This report reveals the financial performance of an organization for the entire reporting period. Cash Flow Statement.

The profit or 2 the Balance Sheet Balance Sheet The balance sheet is one of the three fundamental financial statements. SEBI and Stock Exchanges. A statement that captures how cash flow is affected by activities from the balance sheet and income statement categorized into operating investing and financing activities. The balance sheet the income statement and the cash flow statement are three of the most significant financial statements used in performance analysis. There are four main types of financial statements which are as follows. This report reveals the financial performance of an organization for the entire reporting period. The income statement is sometimes called the statement of financial performance because this statement lets the users assess and measure the financial performance of an entity from period to period of the similar entity competitors or the entity itself. Income statement balance sheet and cash flow statement. In other words it lists the resources obligations and ownership details of a company on a specific day. Cash Flow Statement.