The consolidation method records investment in subsidiary as an asset on the parent companys balances while recording an equal transaction in the equity side of the subsidiarys balance sheet. You divide investments on a balance sheet into long-term and short-term investments. The consolidated balance sheet also includes foreign subsidiaries. Simply so where does investment in subsidiary go on the balance sheet. Quoted investments in the balance sheet stocks for instance can go in either section depending on whether youre holding them for a few months or years. Whereas the subsidiary company will report the same transaction as equity in its balance sheet. There are several approaches to. However it is sometimes difficult to convert the. This has been treated as an investment in a subsidiary in the draft accounts at cost. Illustration 1 The Balance Sheet of the H Ltd.

On acquisition the balance sheet of the parent will show the investment in subsidiary as 1000 for the purchase of shares from Mr X. Parent investment in a subsidiary previously accounted for as an asset in the parents balance sheet and as equity in the subsidiaries balance sheet is eliminated. To do this debit Intercorporate Investment and credit Cash. The exchange rate at the date of the balance sheet For opening net assets these were translated in last years financial statements at last years closing rate and must be retranslated for this years financial statements at this years closing rate. At the end of the financial year the SOFP of the overseas subsidiary will be translated using the closing rate ie. Subsequent to this the subsidiary company prepared accounts to 30 April 2016 which showed all assetsliabilities had been stripped out. There are several approaches to. Whatsapp Instagram are subsidiaries of Facebook Inc. However it is sometimes difficult to convert the. You divide investments on a balance sheet into long-term and short-term investments.

Parent investment in a subsidiary previously accounted for as an asset in the parents balance sheet and as equity in the subsidiaries balance sheet is eliminated. At the end of the financial year the SOFP of the overseas subsidiary will be translated using the closing rate ie. It is the debit amount of investment in subsidiary in the parents accounts and the credit amount of sharecapital in subsidiarys accounts that are elimnated as a consolidation adjustment. To do this debit Intercorporate Investment and credit Cash. However it is sometimes difficult to convert the. As on 31st March 2014 are given below. The subsidiarys retained earnings are allocated proportionally to controlling and non-controlling interests. These statements are key to both financial modeling and accounting. On acquisition the balance sheet of the parent will show the investment in subsidiary as 1000 for the purchase of shares from Mr X. The parent company will report the investment in subsidiary as an asset in its balance sheet.

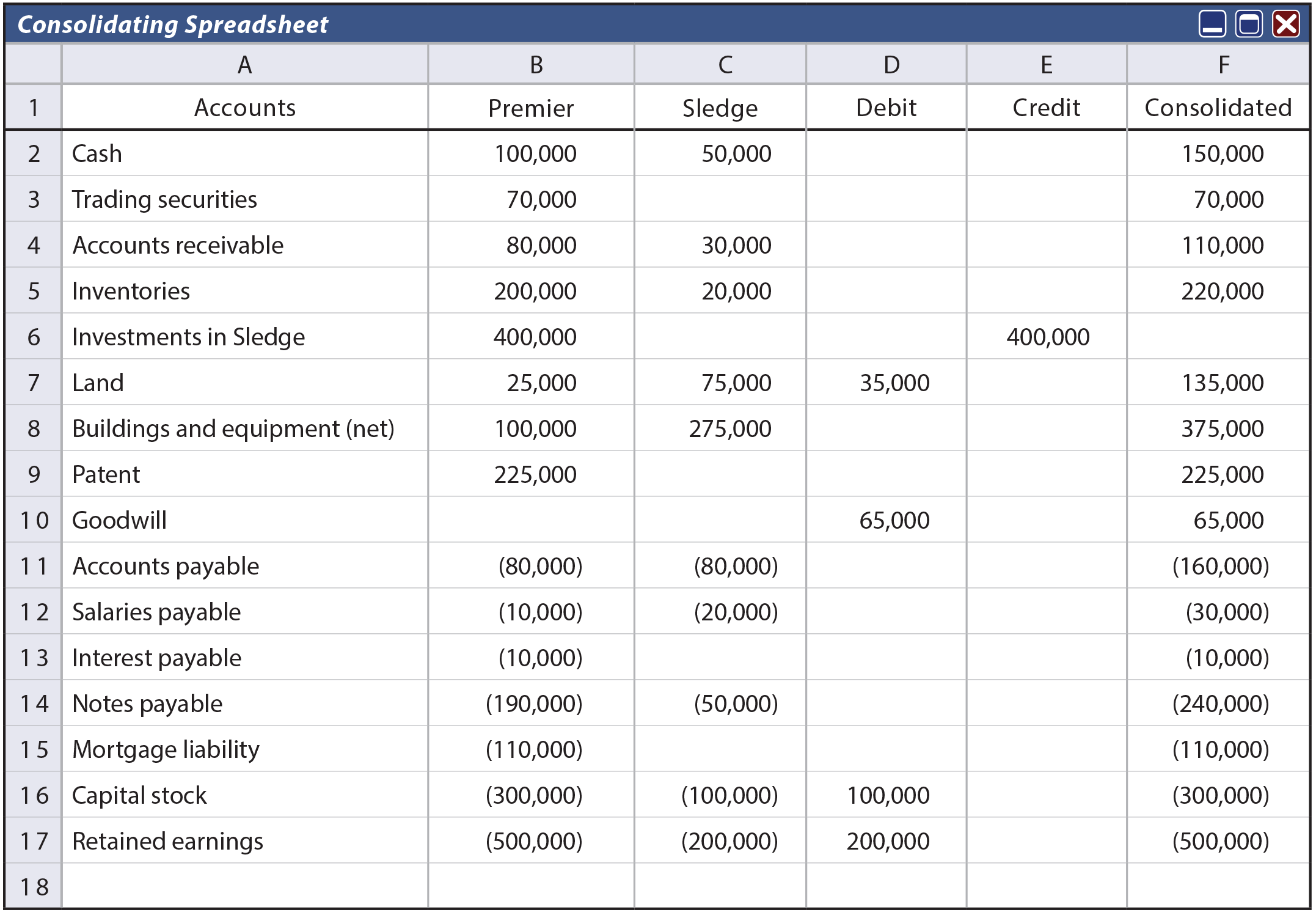

For example if the parent bought 50000 worth of a subsidiarys stock it would debit Intercorporate Investment for 50000 to reflect the new asset and credit cash for 50000 to reflect the cash outflow. While preparing the Consolidated Balance Sheet investments of the holding company in shares of subsidiary company have simply to be replaced by the net assets ie total assets and liabilities of subsidiary company. On acquisition the balance sheet of the parent will show the investment in subsidiary as 1000 for the purchase of shares from Mr X. 2 Record any dividends that the subsidiary pays the parent company. The consideration was 400000. The consolidation method records investment in subsidiary as an asset on the parent companys balances while recording an equal transaction in the equity side of the subsidiarys balance sheet. It is the debit amount of investment in subsidiary in the parents accounts and the credit amount of sharecapital in subsidiarys accounts that are elimnated as a consolidation adjustment. This has been treated as an investment in a subsidiary in the draft accounts at cost. At the end of the financial year the SOFP of the overseas subsidiary will be translated using the closing rate ie. The consolidated balance sheet also includes foreign subsidiaries.

On acquisition the balance sheet of the parent will show the investment in subsidiary as 1000 for the purchase of shares from Mr X. At the end of the financial year the SOFP of the overseas subsidiary will be translated using the closing rate ie. However it is sometimes difficult to convert the. The subsidiarys retained earnings are allocated proportionally to controlling and non-controlling interests. Parent investment in a subsidiary previously accounted for as an asset in the parents balance sheet and as equity in the subsidiaries balance sheet is eliminated. It is the debit amount of investment in subsidiary in the parents accounts and the credit amount of sharecapital in subsidiarys accounts that are elimnated as a consolidation adjustment. You divide investments on a balance sheet into long-term and short-term investments. Quoted investments in the balance sheet stocks for instance can go in either section depending on whether youre holding them for a few months or years. This has been treated as an investment in a subsidiary in the draft accounts at cost. Whatsapp Instagram are subsidiaries of Facebook Inc.