Preparing Your Cash Flow Statement. An accurate cash flow forecast helps companies predict future cash positions avoid crippling cash shortages and earn returns on any cash surpluses they may have in the most efficient manner possible. Cash flow analysis deals with the movement of only actual or notional cash. Cash flow is a measure of a companys net cash inflows and outflows. Discover the Secret to Driving Growth Profitability and Cash Flow and the book Never Run Out of Cash. So it includes your bank account and short term investments that can be converted to cash quickly. Although it does sometimes seem that cash flow only goes one wayout of the businessit does flow both ways. Philip Campbell is an experienced financial consultant and author of the book A Quick Start Guide to Financial Forecasting. Cash Flow Analysis Law and Legal Definition Cash flow analysis refers to the study of the cycle of ones business cash inflows and outflows. The simple definition is to take your ending cash balance and divide by daily cash operating expenses Total Operating Expenses less Depreciation and Amortization.

Philip Campbell is an experienced financial consultant and author of the book A Quick Start Guide to Financial Forecasting. The purpose of a cash flow analysis is to maintain an adequate cash flow for ones business and to provide the basis for cash flow management. Cash flow analysis deals with the movement of only actual or notional cash. A cash flow analysis is a method for examining how a business generates and spends money over a specific period of time. The 10 Cash Flow Rules You Cant Afford to IgnoreHe is also the author of a number of online courses including Understanding Your Cash Flow In Less Than 10. But funds flow is concerned with all the items constituting funds ie net working capital. An accurate cash flow forecast helps companies predict future cash positions avoid crippling cash shortages and earn returns on any cash surpluses they may have in the most efficient manner possible. Definition of Cash Flow Definition. Its reported in a cash flow statement also known as a statement of cash flows. What Does Cash.

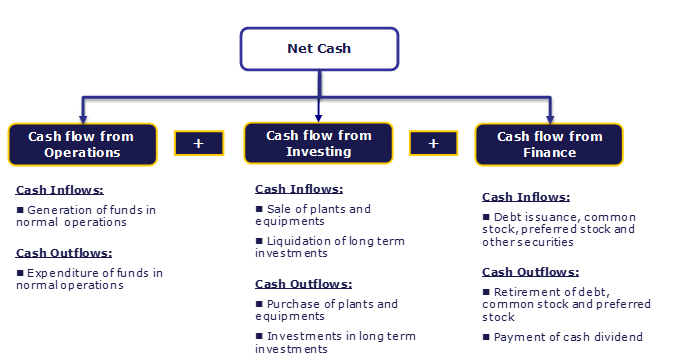

The 10 Cash Flow Rules You Cant Afford to IgnoreHe is also the author of a number of online courses including Understanding Your Cash Flow In Less Than 10. But funds flow is concerned with all the items constituting funds ie net working capital. It tells you how cash moves in and out of a companys accounts via three main. Cash Flow Analysis is the evaluation of a companys cash inflows and outflows from operations financing activities and investing activities. Cash flow forecasting is the process of estimating the flow of cash in and out of a business over a specific period of time. The amount of cash or cash-equivalent which the company receives or gives out by the way of payments to creditors is known as cash flow. The cash flow statement also called the statement of cash flows is a financial statement showing how cash flows in and out of a company over a specific period of time. So it includes your bank account and short term investments that can be converted to cash quickly. Cash is really cash and cash equivalents stuff you can use to pay your bills. Cash flow analysis is often used to analyse the liquidity position of the company.

So it includes your bank account and short term investments that can be converted to cash quickly. It can help you figure out where your money is going and how much cash you have available at a given moment. What Does Cash. But funds flow is concerned with all the items constituting funds ie net working capital. An accurate cash flow forecast helps companies predict future cash positions avoid crippling cash shortages and earn returns on any cash surpluses they may have in the most efficient manner possible. The amount of cash or cash-equivalent which the company receives or gives out by the way of payments to creditors is known as cash flow. The simple definition is to take your ending cash balance and divide by daily cash operating expenses Total Operating Expenses less Depreciation and Amortization. Cash flow is the money that is moving flowing in and out of your business in a month. The purpose of a cash flow analysis is to maintain an adequate cash flow for ones business and to provide the basis for cash flow management. Its reported in a cash flow statement also known as a statement of cash flows.

The purpose of a cash flow analysis is to maintain an adequate cash flow for ones business and to provide the basis for cash flow management. Cash flows from financing activities are defined as cash receipts from the getting hold by securities third parties issued by the company or resources granted by financial or third entities in the form of loans or other financial instruments as well as payments made by redemption or repayment of the amounts contributed by them. Cash is coming in from customers or clients who are buying your products or services. Definition of Cash Flow Definition. A cash flow forecast breaks down the various components involved in deriving what will make up or contribute to a future cash position. This app is available for users with the Cash Manager or Cash Management Specialist roles. It tells you how cash moves in and out of a companys accounts via three main. The data presented in the app can be used to give a high-level overview and detailed insight into the cash flow status to the management. But funds flow is concerned with all the items constituting funds ie net working capital. It can help you figure out where your money is going and how much cash you have available at a given moment.