The best part of ratio analysis is they act as a comparison point for companies. For example comparing PE ratios of companies is a common point of reference for investors. Liquidity solvency efficiency profitability equity market prospects investment leverage and coverage. Quite satisfactory because the current ratio of the company is 214. The percentages on the common-size statements are ratios although they only compare items within a financial statement. The fact is also supported by quick ratio which more then the ideal ratio of 1. A financial statement is frequently mentioned as an account even though the word financial statement is also mostly. For example return on investment and return on assets are two commonly calculated financial ratios that are used in multiple ways to judge a companys return on certain financial. Any ratio shows the relative size of the two items compared just as a fraction compares the numerator to the denominator or a percentage compares a part to the whole. It gives you a better picture of how well it can make payments on its current debts.

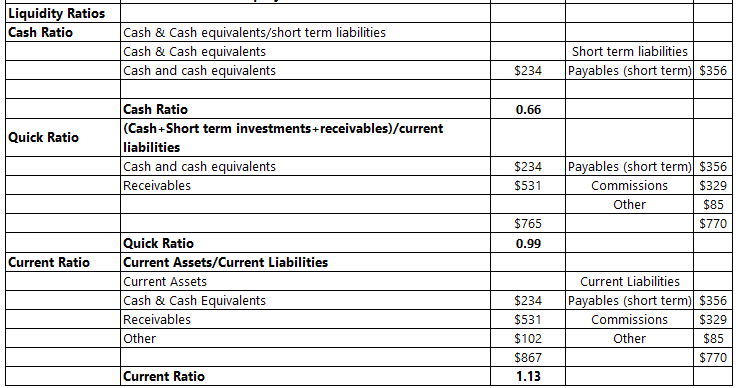

The cash ratio will tell you the amount of cash a company has compared to its total assets. 1 which is more then the ideal ratio of 2. For instance financial ratio can be divided into several categories such as market debt ratio liquidity ratio profitability ratio investment ratio. It measures the return on the money the investors have put into the company. The fact is also supported by quick ratio which more then the ideal ratio of 1. Asset size total asset. The mathematical calculation was establish for ratio analysis between two companies from 2007-2008It is most important factors for performance evaluation. This is the ratio potential investors look at when deciding whether or not to invest in the company. For example comparing PE ratios of companies is a common point of reference for investors. Accounting ratios are the ratios that expressed and counted based on the financial statement of a company.

Financial ratios utilized in measuring liquidity of the hospitals profit evaluation debt structure management of cash flow risk determination of corporate and competitor analysis Curtis Roupas 2009. If the stock is selling for 60 per share and the companys earnings are 2 per share the ratio of price 60 to earnings 2 is 30 to 1. Financial ratios can also utilize in comparing business performance of two or more hospitals and also to assess effectiveness of management. When comparing companies the differences in the choice of inventory valuation method may significantly affect the comparability of financial ratios between companies. Although ratio calculation is relatively straightforward it is not just the base number that matters. In the British English also including the United Kingdom company rule. As a result a restatement from the LIFO method to the FIFO method is critical for making a valid comparison with companies using a method other than the LIFO method. A financial statement is frequently mentioned as an account even though the word financial statement is also mostly. Any ratio shows the relative size of the two items compared just as a fraction compares the numerator to the denominator or a percentage compares a part to the whole. This is the ratio potential investors look at when deciding whether or not to invest in the company.

Financial ratios utilized in measuring liquidity of the hospitals profit evaluation debt structure management of cash flow risk determination of corporate and competitor analysis Curtis Roupas 2009. The quick ratio also called the acid test ratio will compare a companys cash marketable securities and receivables against its liabilities. The best part of ratio analysis is they act as a comparison point for companies. Accounting ratios are the ratios that expressed and counted based on the financial statement of a company. It measures the return on the money the investors have put into the company. It is calculated by dividing total debt by the sum of debt plus equity. A financial ratio shows one financial measure in relationship to another. For example the debt to equity ratio is a financial ratio. When comparing companies the differences in the choice of inventory valuation method may significantly affect the comparability of financial ratios between companies. For example return on investment and return on assets are two commonly calculated financial ratios that are used in multiple ways to judge a companys return on certain financial.

Accounting ratios are the ratios that expressed and counted based on the financial statement of a company. As a result a restatement from the LIFO method to the FIFO method is critical for making a valid comparison with companies using a method other than the LIFO method. The mathematical calculation was establish for ratio analysis between two companies from 2007-2008It is most important factors for performance evaluation. Assets and the non-current assets which is holding by a company. A financial ratio shows one financial measure in relationship to another. Instead of dissecting financial statements to compare how profitable companies are an investor can use this ratio instead. For instance financial ratio can be divided into several categories such as market debt ratio liquidity ratio profitability ratio investment ratio. For example suppose company ABC and company. Return on Equity ROE The Return on Equity ratio is perhaps the most important of all the financial ratios to investors in the company. A financial statement is frequently mentioned as an account even though the word financial statement is also mostly.