Balance Sheet analysis forms an important part of the credit appraisal and gives a preliminary idea of the financial status of the business firm. Average balances provide a better analytical framework to help understand the banks financial performance. A stylised central bank balance sheet is presented in Table 1. Bank of Americas balance sheet is below from their annual 10K for 2017. Financial strengths and weaknesses of the firm by properly establishing relationship between the items of the balance sheet and the profit and loss account. For example consider the balance sheet above. Analysis of Indicators of Balance-Sheet Risks Four measures of risks to bank balance sheets Our analysis focuses on four important ratios that capture different balance-sheet risks12 A leverage ratio measures risk associated with non-capital funding of overall balance sheets. Interest-bearing deposits in other banks rd party or the result of a mergeracquisition and may have restrictions encumbering its usage. Analysis of balance sheet is one of the core of investing as it helps in understanding the financial health of the company its capital structure how it is financedand analyse the potential value of the business. Cash is cash held on deposit and sometimes banks hold cash for other banks.

Balance Sheet Ratio Analysis. ANALYSIS OF BALANCE SHEET is a book that covers theoretical and practical aspects of financial statement analysis. Importance of Balance Sheet. Cash on deposit in postal banking accounts. A balance sheet also known as a statement of financial position is a formal document that follows a standard accounting format showing the same categories of assets and liabilities regardless of the size or nature of. Building a balance sheet for banks and non-bank financial institutions. Analysis of Indicators of Balance-Sheet Risks Four measures of risks to bank balance sheets Our analysis focuses on four important ratios that capture different balance-sheet risks12 A leverage ratio measures risk associated with non-capital funding of overall balance sheets. These are tables that look similar to the bank balance sheet except that they only record changes in the balance sheet rather than the totals. The Balance Sheet of a Bank Showing its Assets Liabilities and Net Worth at a given. Average balances provide a better analytical framework to help understand the banks financial performance.

These are tables that look similar to the bank balance sheet except that they only record changes in the balance sheet rather than the totals. A central bank balance sheet typically centres around the three traditional central banking functions of a issuer of currency b banker to government and c banker to banks. Relating the business to the balance sheet and income statement. ANALYSIS OF BALANCE SHEET is a book that covers theoretical and practical aspects of financial statement analysis. Banks balance sheet statement of financial position is a two-sided overview of banks asset and liability accounts on a specific date. The banks analyse their Balance Sheet in their own format to form an idea from the lenders angle. Importance of Balance Sheet. The Balance Sheet or Report of Condition Asset Items Liability Items Components of the Income Statement. BALANCE SHEET ANALYSIS Assets Current Assets Liquid Assets Cash and cash due from Central Bank. Annual Report 2017 -18 134 BALANCE SHEET AS AT 31 MARCH 2018 in Thousands Schedule.

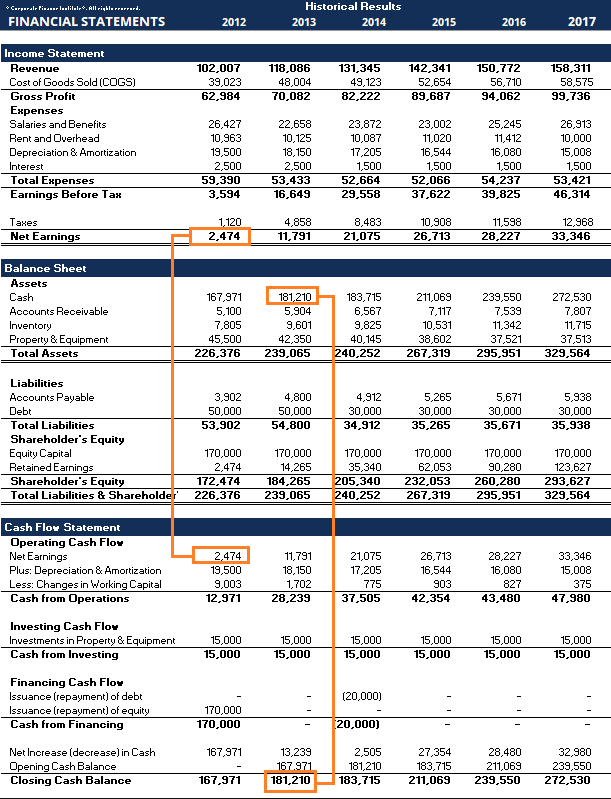

The Balance Sheet of a Bank Showing its Assets Liabilities and Net Worth at a given. Finance and Banking EAR16Turkey Conference ISBN. Analysis of balance sheet is one of the core of investing as it helps in understanding the financial health of the company its capital structure how it is financedand analyse the potential value of the business. RATIO ANALYSIS BANKING FINANCIAL STATEMENTS Fahad Khan. The Balance Sheet or Report of Condition Asset Items Liability Items Components of the Income Statement. Average Balance Sheet and Interest Rates First of all the balance sheet is an average balance for the line item rather than the balance at the end of the period. Balance sheet income statement and cash flow statement. A stylised central bank balance sheet is presented in Table 1. For example consider the balance sheet above. Balance Sheet Ratio Analysis.

These are tables that look similar to the bank balance sheet except that they only record changes in the balance sheet rather than the totals. 42 Significance of Analysis of Financial Statements Financial analysis is the process of identifying the financial strengths and weaknesses of the firm by properly establishing relationships between the various items of the balance sheet and the statement of profit and loss. Risk-free investment such as a bank savings account the owner may be wiser to sell the company put the money in such a savings. Balance Sheet analysis forms an important part of the credit appraisal and gives a preliminary idea of the financial status of the business firm. The Balance Sheet or Report of Condition Asset Items Liability Items Components of the Income Statement. Analysis of Indicators of Balance-Sheet Risks Four measures of risks to bank balance sheets Our analysis focuses on four important ratios that capture different balance-sheet risks12 A leverage ratio measures risk associated with non-capital funding of overall balance sheets. Financial strengths and weaknesses of the firm by properly establishing relationship between the items of the balance sheet and the profit and loss account. Banks balance sheet statement of financial position is a two-sided overview of banks asset and liability accounts on a specific date. For example consider the balance sheet above. Importance of Balance Sheet.